If health is a luxury good, why should we expect the health spending trajectory to change?

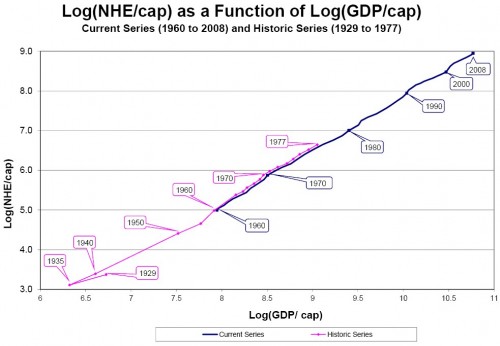

The chart shows that on a log-log scale, the relationship between per capita national health expenditures and per capita GDP is ram-rod straight and has been since 1935.* Based on several statistical tests, Woodward and Wang conclude that there are

no significant changes in either the intercept or the slope for the years of any of the major reforms of the period, including the introduction of Medicare and Medicaid in 1966, in the years following Nixon’s Wage and Price Controls and the health planning legislation of the early 1970s, in the years following Medicare’s introduction of the Prospective Payment System in 1984, or after the widespread adoption of managed care in the 1990s.

With such overwhelming evidence from our past that, despite our efforts, this national health spending curve has not bent, why do we think the future will be much different?

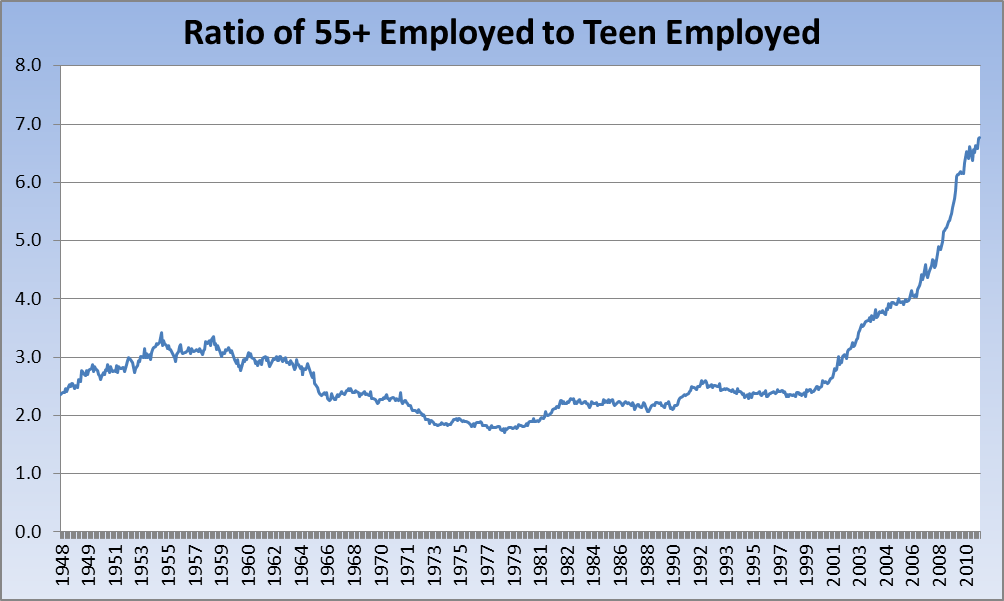

Here’s the ratio of 55+ Employed to Teen Employed. You may notice somethin’ happenin’ here, what it is is exactly clear — in 2001, the exact year referenced by the Journal, the first of the boomers (born in 1946) turned 55. The rest is history:

Is it that 99.2 percent of the people who live in Modesto just don’t realize they have one of the world’s best public transit systems just waiting at their doorsteps? Or did four folks sitting in a conference room at the Brookings Institution design a bad study?

Americans are prone to cycles of belief in decline. The Founding Fathers worried about comparisons to the decline of the Roman republic. Moreover, cultural pessimism is very American, extending back to the country's Puritan roots. As Charles Dickens observed a century and a half ago, "if its individual citizens, to a man, are to be believed, [America] always is depressed, and always is stagnated, and always is in an alarming crisis, and never was otherwise.

As economist David Ricardo pointed out in 1817 in the “On Wages” chapter of his book On the Principles of Political Economy and Taxation, take-home pay is also generally what a person will work for. Employers know this: Ricardo’s “Iron Law of Wages” is rooted in the notion that there is a “market” for labor, driven in part by supply and demand.

So, if a worker is earning, for example, a gross salary of $75,000, his 2009 federal income tax would have been about $18,000, leaving him a take-home pay of $57,000. Both he and his employer know that he’ll do the job for that $57,000 take-home pay.

So let’s take a look at what happens if the government raises income taxes. For our average $75,000-per-year worker, his takehome pay might decrease from $57,000 to $52,000. So, in the short run, increased taxes have an immediate negative effect on him.

But here comes the part the conservatives don’t like to talk about. Our own history shows that within a short time—usually between one and three years—that same worker’s wages will increase enough to more than compensate for his lost income.

Similarly, when the government enacts a tax cut, workingclass people’s taxes go down; but sure enough, over time, their wages also go down so their inflation-adjusted take-home pay remains the same.

Taxes as the Great Stabilizer

Beyond fairness, holding back the landed gentry that the Founders worried about—America had no billionaires in today’s money until after the Civil War, with John D. Rockefeller being our first—in and of itself is an important reason to increase the top marginal tax rate and to do so now.

Novelist Larry Beinhart was the first to bring this to my attention. He looked over the history of tax cuts and economic bubbles and found a clear relationship between the two. High top marginal tax rates—generally well above 60 percent—on rich people actually stabilize the economy, prevent economic bubbles from forming, prevent the subsequent economic crashes, and lead to steady and sustained economic growth as well as steady and sustained wage growth for working people.

On the other hand, when top marginal rates drop below 50 percent, the opposite happens.

The math is pretty simple. When the über-rich are heavily taxed, economies prosper and wages for working people steadily rise. When taxes for the rich are cut, working people suffer and economies turn into casinos.

So why is it that Americans have come to believe that tax cuts are good for everyone? The answer is that for decades now the überrich have relentlessly spent money to make Americans believe that lower taxes are the answer to all of America’s problems. They’ve done this partly through the media they own and partly through funding “think tanks” that legitimize their Great Tax Con.

Here's how...

If you want to place blame for tarmac delays, bad airline customer service, and nickel & diming fees -- look no further than how you yourself purchase plane tickets. As consumers, we choose to purchase services based on any number of criteria that are important to us. In return, suppliers of these services cater their strategies to try to meet our needs and win that business.

If we purchase things as a commodity, it will get sold as a commodity. Plain and simple.

Access to endless amounts of cheap energy made us rich, and wrecked our climate, and it also made us the first people on earth who had no practical need of our neighbors.

Our economy, unlike any that came before it, is designed to work without the input of your neighbors. Borne on cheap oil, our food arrives as if by magic from a great distance (typically, two thousand miles). If you have a credit card and an Internet connection, you can order most of what you need and have it left anonymously at your door. We've evolved a neighborless lifestyle; on average an American eats half as many meals with family and friends as she did fifty years ago. On average, we have half as many close friends.

There are psychological implications of our hyperindividualism. In short, we're less happy than we used to be, and no wonder — we are, after all, highly evolved social animals... And so it heartens me that around the world people are starting to purposefully rebuild communities as functioning economic entities, in the hope that they'll be able to buffer some of the effects of peak oil and climate change.