Some people recite history from above, recording the grand deeds of great men. Others tell history from below, arguing that one person's life is just as much a part of mankind's story as another's. If people do make history, as this democratic view suggests, then two people make twice as much history as one. Since there are almost 7 billion people alive today, it follows that they are making seven times as much history as the 1 billion alive in 1811.The chart below shows a population-weighted history of the past two millennia. By this reckoning, over 28% of all the history made since the birth of Christ was made in the 20th century. Measured in years lived, the present century, which is only ten years old, is already "longer" than the whole of the 17th century. This century has made an even bigger contribution to economic history. Over 23% of all the goods and services made since 1AD were produced from 2001 to 2010, according to an updated version of Angus Maddison's figures.

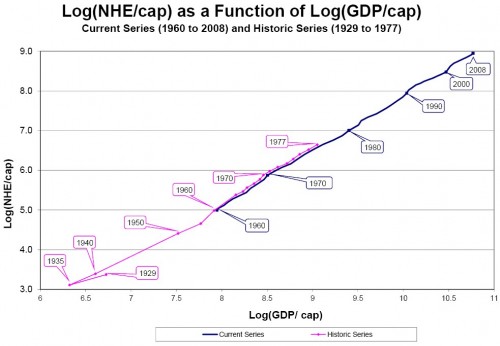

If health is a luxury good, why should we expect the health spending trajectory to change?

The chart shows that on a log-log scale, the relationship between per capita national health expenditures and per capita GDP is ram-rod straight and has been since 1935.* Based on several statistical tests, Woodward and Wang conclude that there are

no significant changes in either the intercept or the slope for the years of any of the major reforms of the period, including the introduction of Medicare and Medicaid in 1966, in the years following Nixon’s Wage and Price Controls and the health planning legislation of the early 1970s, in the years following Medicare’s introduction of the Prospective Payment System in 1984, or after the widespread adoption of managed care in the 1990s.

With such overwhelming evidence from our past that, despite our efforts, this national health spending curve has not bent, why do we think the future will be much different?

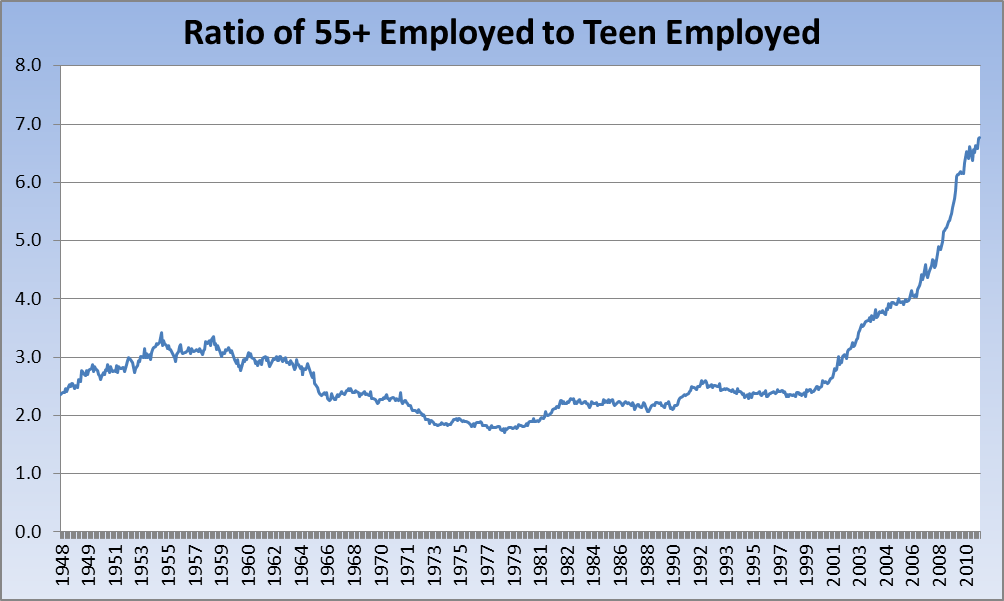

Here’s the ratio of 55+ Employed to Teen Employed. You may notice somethin’ happenin’ here, what it is is exactly clear — in 2001, the exact year referenced by the Journal, the first of the boomers (born in 1946) turned 55. The rest is history:

Americans are prone to cycles of belief in decline. The Founding Fathers worried about comparisons to the decline of the Roman republic. Moreover, cultural pessimism is very American, extending back to the country's Puritan roots. As Charles Dickens observed a century and a half ago, "if its individual citizens, to a man, are to be believed, [America] always is depressed, and always is stagnated, and always is in an alarming crisis, and never was otherwise.

How we got here:

So how did we get to the point where Obama is about to break one of his biggest campaign promises in extending the Bush tax cuts for the wealthy? First, the votes weren’t there for Democrats. On Saturday, Senate Republicans -- assisted by a handful of Democrats -- filibustered two amendments that would have 1) extended the Bush tax cuts only for those making less than $250,000 and 2) extended them for those making less than $1 million. And if Democrats don’t have the votes now, they certainly won’t have them next year when the next Congress convenes. Second, the employment situation is worse off than anyone would have expected a year ago, and that has put an enormous amount of pressure on Democrats not to change the current tax policy, even if the facts don't necessarily fit the narrative that tax cuts create jobs. If the economy was creating 200,000 to 300,000 jobs per month -- instead of the 39,000 in November -- Democrats would have a stronger argument to let the cuts expire. Now? “We don't want to take actions this year that will affect this year's spending and this year's taxes in a way that will hurt the recovery,” Fed Chairman Ben Bernanke said last night on “60 Minutes.”

Fighting vs. getting things done:

Of course, as Paul Krugman advises, President Obama could draw a line in the sand and threaten to veto any legislation that cuts taxes for the wealthy -- either in this lame duck or next year. But in addition to opening himself up to the charge of raising taxes in a struggling economy, that action would also imperil all the other items on Obama’s to-do list: jobless benefits, “Don’t Ask, Don’t Tell” repeal, and ratification of New START. A question for Democrats: Would getting those priorities through the lame duck be worth caving in on the Bush tax cuts? On Sunday, Indiana GOP Sen. Dick Lugar said the votes are there to pass New START. And on Friday, GOP Sen. Scott Brown said he backs DADT repeal, which improves the likelihood of that happening. And then there’s this: Is December -- when few Americans are really paying attention -- really the time to draw a line in the sand and fight?

Why didn’t congressional Democrats work on this six months ago?

Here’s another question for Democrats, especially those on Capitol Hill who are upset that they seem to be caving in on the Bush tax cuts: Why didn’t they work on this last spring/summer, when they might have had a stronger hand to play? As the Times says, “In meetings with administration officials after the Senate votes, the House speaker, Nancy Pelosi, and many other House and Senate Democrats voiced deep unhappiness at the prospect of extending all the tax cuts and also expressed their belief that the White House did not appear to be getting enough for such a big concession.” It was the Capitol Hill Dem leadership -- more than the White House -- that pushed for putting off any votes on the Bush tax cuts. At the time, it was about trying to insulate some vulnerable Democrats from votes on taxes. Talk about short-sighted leadership decisions.

Bigger than the stimulus?

And here’s something to chew on: Extending the Bush tax cuts for two years -- along with extending jobless benefits and targeted tax cuts -- would likely cost more (approximately $1 trillion) than the stimulus cost (approximately $800 billion). Here’s our back-of-envelope math arriving at the $1 trillion approximation: If the price tag of extending the Bush tax cuts over 10 years is nearly $4 trillion, then doing it for two years is some $800 billion. And extending the jobless benefits and targeted tax cuts raises that price tag even higher.

As economist David Ricardo pointed out in 1817 in the “On Wages” chapter of his book On the Principles of Political Economy and Taxation, take-home pay is also generally what a person will work for. Employers know this: Ricardo’s “Iron Law of Wages” is rooted in the notion that there is a “market” for labor, driven in part by supply and demand.

So, if a worker is earning, for example, a gross salary of $75,000, his 2009 federal income tax would have been about $18,000, leaving him a take-home pay of $57,000. Both he and his employer know that he’ll do the job for that $57,000 take-home pay.

So let’s take a look at what happens if the government raises income taxes. For our average $75,000-per-year worker, his takehome pay might decrease from $57,000 to $52,000. So, in the short run, increased taxes have an immediate negative effect on him.

But here comes the part the conservatives don’t like to talk about. Our own history shows that within a short time—usually between one and three years—that same worker’s wages will increase enough to more than compensate for his lost income.

Similarly, when the government enacts a tax cut, workingclass people’s taxes go down; but sure enough, over time, their wages also go down so their inflation-adjusted take-home pay remains the same.

Taxes as the Great Stabilizer

Beyond fairness, holding back the landed gentry that the Founders worried about—America had no billionaires in today’s money until after the Civil War, with John D. Rockefeller being our first—in and of itself is an important reason to increase the top marginal tax rate and to do so now.

Novelist Larry Beinhart was the first to bring this to my attention. He looked over the history of tax cuts and economic bubbles and found a clear relationship between the two. High top marginal tax rates—generally well above 60 percent—on rich people actually stabilize the economy, prevent economic bubbles from forming, prevent the subsequent economic crashes, and lead to steady and sustained economic growth as well as steady and sustained wage growth for working people.

On the other hand, when top marginal rates drop below 50 percent, the opposite happens.

The math is pretty simple. When the über-rich are heavily taxed, economies prosper and wages for working people steadily rise. When taxes for the rich are cut, working people suffer and economies turn into casinos.

So why is it that Americans have come to believe that tax cuts are good for everyone? The answer is that for decades now the überrich have relentlessly spent money to make Americans believe that lower taxes are the answer to all of America’s problems. They’ve done this partly through the media they own and partly through funding “think tanks” that legitimize their Great Tax Con.

Here's how...

That's the annual cost to fliers when planes don't run on time, according to researchers who delivered a report Monday to the Federal Aviation Administration detailing the economic price of domestic flight delays.

The total cost to passengers, airlines and other parts of the economy is $32.9 billion, according to the FAA-commissioned report. More than half that amount comes from the pockets of passengers who lose time waiting for their planes to leave and then spend money scrounging for food and sleeping in hotel rooms while they're stranded, among other costs.

Continuing their party's decades-long War on Arithmetic, Republicans act as if the highest form of patriotism is to demand tax cuts even as a USA Today analysis documents that "Americans paid their lowest level of taxes last year since Harry Truman's presidency ... Federal, state and local taxes -- including income, property, sales and other taxes -- consumed 9.2 percent of all personal income in 2009, the lowest rate since 1950, the Bureau of Economic Analysis reports."

The historic average has been 12 percent.

Along with the recession, the main reason was the Obama stimulus bill, which included one of the largest tax cuts for wage-earners in U.S. history, totaling $282 billion. Republicans opposed it anyway. Almost everybody got a substantial tax break, even if Tea Party patriots don't realize it.

Are we finally in a recovery? Who’s “we,” kemosabe? Big global companies, Wall Street, and high-income Americans who hold their savings in financial instruments are clearly doing better. As to the rest of us – small businesses along Main Streets, and middle and lower-income Americans – forget it.